股票买卖点位如何确定?有什么技巧?

在股票市场,一些短线投资者喜欢利用个股的波段,进行高抛低吸操作。像这样的操作,是要会掌握股票的买卖点位的。但是很多的新手投资者对于股票买卖点位都不知道怎么确定?接下来就跟着我一起来了解一下有哪些技巧吧。

1、一根K线定输赢,在突破前一天收盘价上进行买卖是好方法,起浪的源头是一根红K,损失一根K线就立刻停损。这种最犀利的停损法才值得去练习,虽然认赔是没有面子,但却因此保住了票子,这是如何确定买卖点位的要点方法之一。

2、进场后股价走势与自己的判断相反,第一时间立即纠正,不想在此价位买进,出来等,不能盈利和不能快速盈利,尽快摆脱这笔交易,最坏的情况就是:不要到不得不退出的时候才退出。

3、一波行情有规律,涨三不追,三阴出局,下跌横盘,费时亏钱,绝不容忍,常遭埋怨。一吋短一吋险,短线于短线,增加受伤的机会,不是每次都对。高位突破多是到顶,大势不好的突破多是骗,冲顶太远不能沾,这是如何确定买卖点位要特别注意的一点。

4、操盘原则,逆水行舟,不进则退,风险巨大坚决不要碰。上涨严格挑毛病,下跌决不找理由。

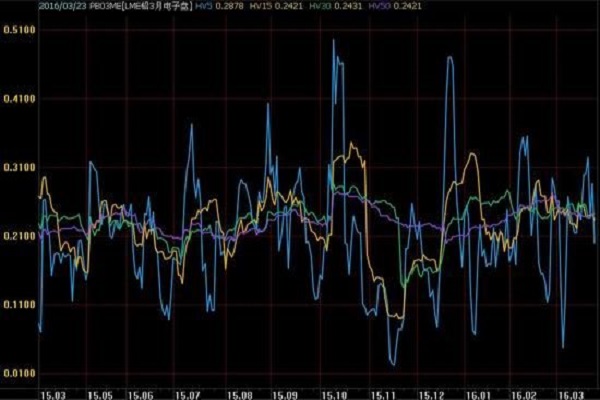

5、均线,当股价下跌跌破下方某一均线时,比如,5日均线,则投资者可以考虑卖出手中的股票,当股价上涨,突破上方某一均线时,比如,5日均线,则投资者可以考虑买入一些。

6、历史的高位和压力位,当股价上涨突破到历史的高点时,拐头向下运行,则卖出个股,反之,当股价下跌触碰到历史的低位,出现反弹时,可以考虑买入一些。

买卖股票是有一定的技巧和方法的,一定要掌握好买卖点位,如果没有扎实的功底千万不要去盲目的去买股票,股民亏损了也不知道怎么回事。

免责声明:本站所有资源均来自用户分享和网络收集,资源版权归原作者所有,仅供研究使用,禁止商业用途,如果损害了您的权利,请联系网站客服,我们尽快处理。 【免费的东西不长久,支持作者才有动力开发】